Skip to content

Consumer Products Conundrum 1

Earlier this week I had the pleasure of attending the Fall Convention of the Adhesive and Sealant Council (ASC) in beautiful Greenville, South Carolina. I was on their docket to talk about the consumer packaged goods industry (CPG) and we had quite a good conversation.

ASC members, like all suppliers to this industry, need to understand and navigate the not insignificant challenges facing their CPG customers. Let’s talk about a few of those challenges here.

The first and perhaps most daunting challenge facing CPG is their own success. The question is: Is it possible to be too rich?

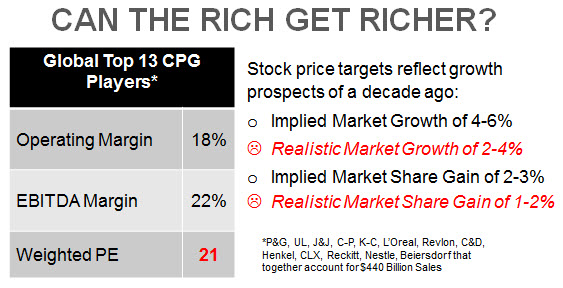

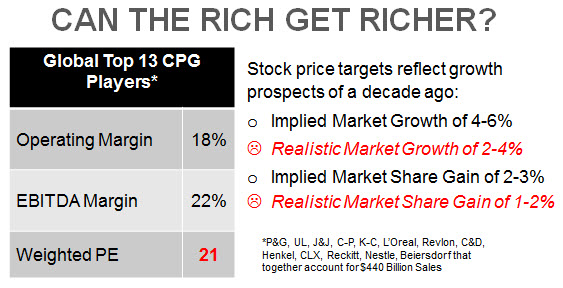

Every major CPG executive goes to work with an albatross hanging over his or her head. That albatross is a stock price and profit structure that require incredible and unrealistic results to sustain. The chart above lays out the problem.

On average, CPG companies put more than 20 cents of every dollar of sales into their pockets as cash. Wall Street loves this profit structure but values CPG stocks based on totally unrealistic growth expectations.

CPG’s most profitable markets -North America, Europe and Japan- aren’t growing anywhere near the rates needed to justify current stock prices. In fact many big product categories in these markets are flat or declining.

Meanwhile, the attractive growth coming in developing countries actually puts a drag on CPG earnings because that growth comes with significantly lower profit margins. While developing countries are rapidly minting new middle class families -CPG’s prime prospect- these markets lack the infrastructure, distribution systems and optimized supply chains that account for CPG’s current profitability.

This creates a difficult and unhealthy dynamic. ROI on expansionary investments -new plants and equipment, new subsidiary operations, brand development, etc.- is less attractive than cost cutting or stock repurchases. And juicing growth in home markets could require expensive and dilutive price and marketing battles that CPG players have, up to this point, largely avoided.

Simply put, CPG’s fuel mixture is too rich to power their best potential growth vehicles.

Share This Story, Choose Your Platform!